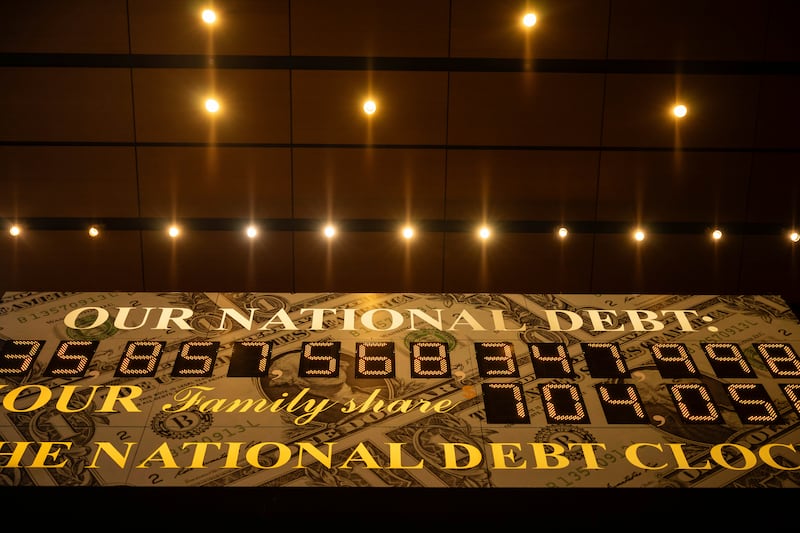

The U.S. national debt surpassed $38 trillion on Wednesday, reaching its fastest-ever $1 trillion increase outside the COVID-19 pandemic.

The American national debt hit $1 trillion in 1981, $2 trillion in 1987 and $3 trillion in 1990. Now, the national debt is rising by $1 trillion about every 180 days, with no end in sight.

Over the next 10 years, the Congressional Budget Office predicts federal spending will total $88 trillion (23.6% of GDP), while revenue will total more than $65 trillion (17.5% of GDP).

Michael Peterson, CEO of the Peter G. Peterson Foundation, a nonprofit focused on finding long-term fiscal solutions for the federal government, told Fox Business that “reaching $38 trillion in debt during a government shutdown is the latest troubling sign that lawmakers are not meeting their basic fiscal duties.”

“If it seems like we are adding debt faster than ever, that’s because we are,” he continued.

“We passed $37 trillion just two months ago, and the pace we’re on is twice as fast as the rate of growth since 2000,” Peterson said.

Just as the debt itself is rising, the cost of servicing it is skyrocketing as well. Interest payments on the debt cost Americans $4 trillion over the past decade, and the CBO is estimating it will cost $14 trillion in the next 10 years.

Elon Musk says the debt is hopeless without AI and robots

Mid-September, Elon Musk spoke with the “All-In” podcast hosts about the national debt and his time leading the federal government’s Department of Government Efficiency.

“That was a hell of a side quest,” he said, laughing. “The government is basically unfixable.”

“It’s good to have talented people in the administration, but at the end of the day, if you look at our national debt, which is insanely high, the interest payments exceed the War Department’s budget, and they keep rising. ... If AI and robots don’t solve our national debt, we’re toast,” he said.

Musk and President Donald Trump’s public falling out centered on the president’s “big, beautiful bill” increasing the national debt, even though it codified $9 billion in spending cuts DOGE identified in fraud, waste and abuse.

The “big, beautiful bill” will add more than $4 trillion to the national debt, according to the Bipartisan Policy Center.

U.S. Treasurer says the budget deficit has shrunk since Trump took office

Following reports that the national debt had surpassed $38 trillion, Treasurer Scott Bessent posted a graphic, titled “Lowest Post-Pandemic Budget Deficit,” saying the national budget deficit has shrunk dramatically since Trump took office in his second term.

The budget deficit measures the difference between government spending and tax collection, and the national debt measures the total amount the government owes after years of deficits.

“From April to September, the cumulative deficit totaled just $468 billion. This is the lowest reading since 2019 and is down nearly 40% from the comparable period last year when Biden was spending recklessly. Today, President Trump is putting the U.S. financial system on solid footing,” Bessent said.

He continued, “Revenues are soaring and government spending is under control. Democrats think they can undo the important progress the President has made by shutting down the government. But they will not succeed.”

Some congressmen see both parties at fault for the national debt

After voting no on the most recent continuing resolution to reopen the federal government, Sen. Rand Paul, R-Ky., said the Republican plan would lead to a $2 trillion deficit in 2026, and the Democratic plan would lead to a $3 trillion deficit.

“These are Biden-spending levels in the Republican C.R.,” Paul said.

“My opposition is that the debt threatens our national security, threatens our economic security, and I don’t think we can keep piling on debt at this rate. We just turned $38 trillion for overall U.S. debt, and we have real problems ahead of us, with the devaluation of our currency, inflation rising prices — so someone’s got to hold the line to say, we can’t keep doing it the same way,” he said.